As a business owner or entrepreneur, one of the most important aspects of running a successful business is tracking growth. However, growth is not always easy to measure, and without the right metrics, it’s difficult to understand how your business is truly performing. That’s where key performance indicators (KPIs) come into play. By measuring and analyzing the right KPIs, you can gain actionable insights into your business’s success and areas that need improvement.

In this article, we will explore five key metrics to track business growth effectively. These metrics can provide valuable insights into your financial health, customer satisfaction, and overall performance, helping you make informed decisions and drive sustainable growth.

Why Tracking Metrics is Crucial for Business Growth

Tracking business metrics is essential because it gives you a clear picture of where your business stands and how it is evolving. Business growth is not just about increasing revenue—it involves a comprehensive view of various areas such as customer engagement, profitability, and efficiency. Monitoring these metrics allows you to:

- Identify trends: Spot patterns in sales, marketing efforts, or customer behaviors.

- Measure effectiveness: Understand which strategies are working and which need adjustments.

- Optimize resources: Allocate time, effort, and capital more effectively based on data-driven insights.

- Make informed decisions: Instead of guessing, you’ll have the data to back up your business strategies.

Let’s explore the five key metrics that every business owner should track to ensure effective growth.

1. Revenue Growth

What is Revenue Growth?

Revenue growth is one of the most straightforward and important indicators of business success. It tracks how much your business’s income has increased over a specific period. This metric can give you a clear indication of how well your products or services are selling, and it’s essential for understanding the financial health of your business.

Why Revenue Growth Matters

- Growth trajectory: A steady increase in revenue indicates that your business is expanding.

- Investor confidence: If you’re seeking investment or loans, a consistent growth in revenue is a major factor in securing funding.

- Strategic decision-making: If you’re seeing strong growth, you might consider reinvesting into your business to accelerate further expansion.

How to Track Revenue Growth

To track revenue growth effectively, calculate the percentage increase in your revenue over a specific period (e.g., monthly, quarterly, or annually). For example, you might compare your current quarter’s revenue with the same quarter from the previous year to assess year-over-year growth.

Formula:Revenue Growth Percentage=(Current Period Revenue−Previous Period RevenuePrevious Period Revenue)×100\text{Revenue Growth Percentage} = \left( \frac{\text{Current Period Revenue} – \text{Previous Period Revenue}}{\text{Previous Period Revenue}} \right) \times 100Revenue Growth Percentage=(Previous Period RevenueCurrent Period Revenue−Previous Period Revenue)×100

Tracking this metric can help you pinpoint periods of significant growth or declines, allowing you to adjust your business strategies accordingly.

2. Customer Acquisition Cost (CAC)

What is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost (CAC) is the amount of money your business spends to acquire a new customer. This metric includes all marketing and sales expenses—such as advertising, promotions, and salaries for salespeople—divided by the total number of new customers acquired in that period.

Why CAC Matters for Business Growth

- Efficiency assessment: A high CAC means you’re spending too much to acquire customers, which could limit profitability.

- Marketing and sales optimization: Tracking CAC helps you identify if your marketing and sales efforts are effective or if adjustments are needed.

- Profitability insights: If CAC is too high, it could mean that your business isn’t scalable in the long run, even if your revenue is growing.

How to Track CAC

To calculate CAC, divide your total sales and marketing expenses by the number of customers you acquired in that time period.

Formula:CAC=Total Marketing and Sales ExpensesNumber of New Customers Acquired\text{CAC} = \frac{\text{Total Marketing and Sales Expenses}}{\text{Number of New Customers Acquired}}CAC=Number of New Customers AcquiredTotal Marketing and Sales Expenses

Once you have your CAC, it’s crucial to monitor it regularly. If CAC is too high, you might need to revisit your marketing strategies or optimize your sales funnel to reduce costs.

3. Customer Lifetime Value (CLV)

What is Customer Lifetime Value (CLV)?

Customer Lifetime Value (CLV) is the total revenue you expect to earn from a customer over the entire duration of their relationship with your business. By understanding CLV, you can measure the long-term value of a customer and determine how much you should spend on acquiring new customers.

Why CLV Matters for Business Growth

- Profitability prediction: CLV gives you insight into the long-term profitability of your customer base.

- Informed decision-making: By knowing how much a customer is worth over their lifetime, you can make smarter decisions about marketing, product pricing, and customer service.

- Focus on retention: A high CLV suggests that your customer retention strategies are working, leading to more sustainable growth.

How to Track CLV

To calculate CLV, multiply the average revenue you earn from a customer per period by the average customer lifespan. The formula can be simplified as:

Formula:CLV=Average Purchase Value×Average Purchase Frequency×Average Customer Lifespan\text{CLV} = \text{Average Purchase Value} \times \text{Average Purchase Frequency} \times \text{Average Customer Lifespan}CLV=Average Purchase Value×Average Purchase Frequency×Average Customer Lifespan

CLV can help guide your marketing and retention efforts, ensuring you’re not just acquiring customers but nurturing relationships that lead to long-term revenue.

4. Net Profit Margin

What is Net Profit Margin?

Net Profit Margin is the percentage of revenue that remains as profit after all expenses, taxes, and costs have been deducted. This metric provides a clear picture of your company’s financial health and how efficiently it is managing costs in relation to its revenue.

Why Net Profit Margin Matters

- Profitability assessment: A higher net profit margin indicates a more profitable business that’s managing its expenses well.

- Cost management: By tracking this metric, you can identify areas where costs can be cut or where more investment might be needed.

- Investor interest: Investors often look at net profit margin to determine the potential for long-term growth and return on investment.

How to Track Net Profit Margin

To calculate your net profit margin, subtract total expenses from your total revenue and then divide the result by your total revenue.

Formula:Net Profit Margin=(Net ProfitTotal Revenue)×100\text{Net Profit Margin} = \left( \frac{\text{Net Profit}}{\text{Total Revenue}} \right) \times 100Net Profit Margin=(Total RevenueNet Profit)×100

This metric helps you understand how much profit you’re keeping from each dollar of revenue, providing insights into both your cost structure and pricing strategy.

5. Churn Rate

What is Churn Rate?

Churn rate is the percentage of customers who stop doing business with your company over a specific period. This metric is particularly important for subscription-based businesses or those with a recurring revenue model. A high churn rate can signal problems with customer satisfaction, product quality, or competition.

Why Churn Rate Matters

- Customer retention insights: A high churn rate may indicate that your business is struggling to retain customers, which can impede growth.

- Service improvements: Monitoring churn helps you identify areas where your customer service or product offerings need to improve.

- Cost of acquisition vs. retention: If you have a high churn rate, you may need to invest more in customer retention strategies to keep acquisition costs manageable.

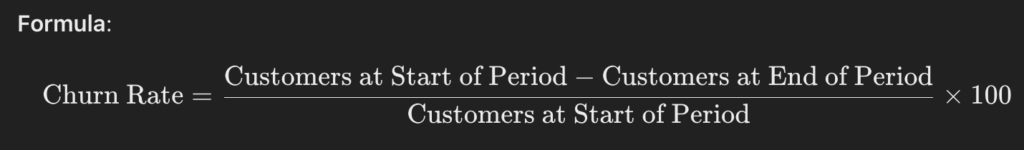

How to Track Churn Rate

To calculate churn rate, subtract the number of customers at the end of a period from the number of customers at the beginning, and divide that by the number of customers at the start of the period.

A low churn rate is a positive sign that your business is building strong, long-term customer relationships, leading to sustainable growth.

Conclusion: Key Metrics for Effective Business Growth

Measuring business growth requires more than just tracking revenue. By focusing on key metrics such as revenue growth, CAC, CLV, net profit margin, and churn rate, you can gain a more comprehensive understanding of your business’s health and growth trajectory. These metrics allow you to make data-driven decisions that will help your business grow faster and more sustainably.

Remember, the most successful businesses track and analyze their KPIs regularly, adjusting their strategies to stay on course. By focusing on these five essential metrics, you’ll be well-equipped to steer your business toward long-term success.